Closing Cost Calculator for Buyers All 50 States 2022

Table of Content

This ensures that no one else has a claim to the property you’re buying. Similar to a test for lead paint, a pest inspection inspects the home you’re buying for termites or dry rot. This inspection is required on some government loans and by certain states.

With an FHA loan, there is an upfront mortgage insurance premium, plus a monthly MIP fee for the life of the loan unless you make a down payment of 10% or more. USDA loans have an upfront guarantee fee and an annual guarantee fee that function similarly to PMI/MIP. While this is general advice, Rocket Mortgage® doesn’t offer USDA loans at this time. Loan origination fees cover the cost of processing and underwriting your loan.

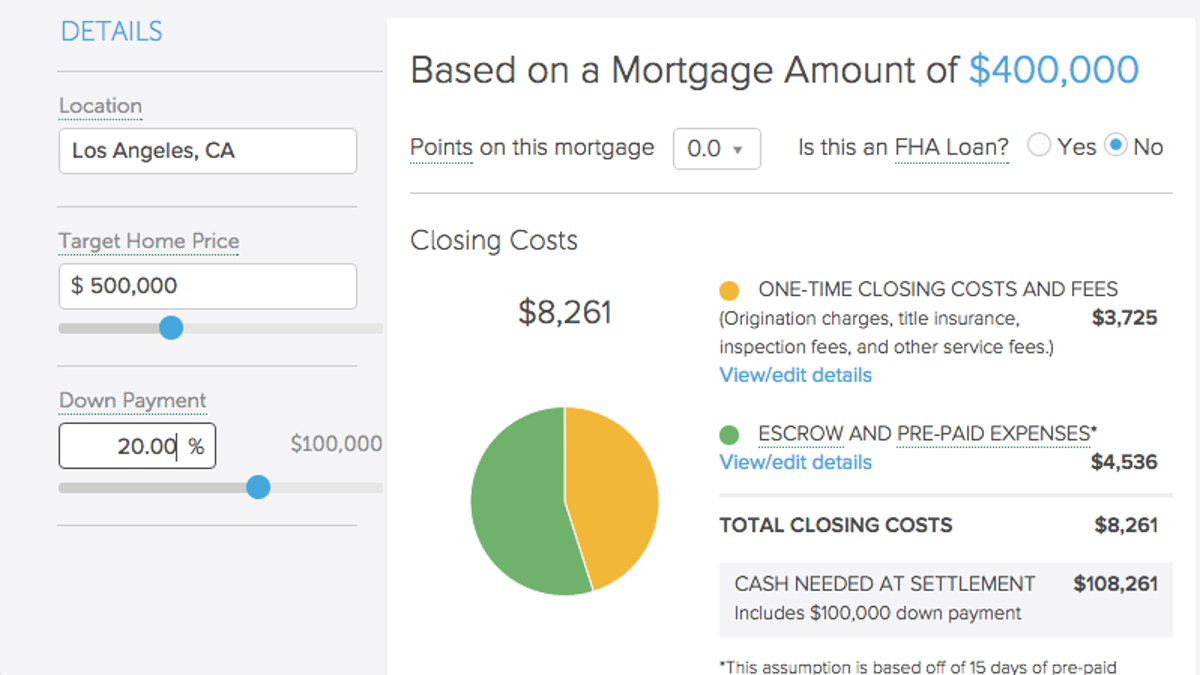

This tool will help you understand your total closing costs and amount needed at settlement.

This fee is determined by the county in which the property is located. The county records details of the transaction and the new owner’s information for tax purposes each time a home is bought and sold. The process of recording it also solidifies your legal ownership of the property.

Many of the standard closing costs are fixed, so buyers pay the same amount, regardless of where financing is obtained. Registering deeds and documents, for example, is typically done for a flat fee. Some ancillary expenses, on the other hand, are negotiable and subject to the discretion of lenders and other real estate transaction partners. It is important for buyers to know the difference, and to understand where closing costs originate. A down payment and monthly mortgage payment aren’t the only costs you’re looking at when buying a new home. Some buyers forget that they will also have to pay closing costs.

How to Sell Your House With Little Effort

Homeowners insurance is a type of protection that compensates you if your home gets damaged. Most mortgage lenders require you to have at least a certain amount of homeowners insurance as a condition of your loan to cover damage. You have the option of also getting protection for the contents within your home and liability coverage if someone gets injured on your property. Your homeowners association transfer fee covers the cost of moving the burden of HOA fees from the seller to the buyer. It also provides you with a copy of the association’s payment and due schedule as well as their financials. Closing costs don’t include your down payment, but can be negotiated.

The Daily Upside Newsletter Investment news and high-quality insights delivered straight to your inboxGet Started Investing You can do it. Additionally, you will receive a closing disclosure near your closing date to make sure you are aware of all the expenses. When you receive a Loan Estimate from a lender, consider asking for a discount. Although some lenders won’t be willing to work with you, others will. Don’t forget to factor in these costs when you’re looking to buy.

Buyer closing costs vs. seller closing costs

This includes a guarantee fee of 1% of the total loan amount. As the buyer, you can’t have the seller pay more than 4% of the total loan amount in closing costs. Sellers are also not allowed to pay for any loan discount points. If you are paying cash, you can call the title company or law office that is handling the transaction and ask them to estimate the closing costs for you. Determine whether to offer a home warranty as part of your seller closing costs. In a weak housing market, where people are having a hard time selling their homes, this may be a good incentive for a buyer to purchase your home.

Programs, rates, terms and conditions are subject to change without notice. We ask for your email address so that we can contact you in the event we're unable to reach you by phone. If you're concerned about receiving marketing email from us, you can update your privacy choices anytime in the Privacy and Security area of our website. At NerdWallet, our content goes through a rigourous editorial review process. We have such confidence in our accurate and useful content that we let outside experts inspect our work. Check your buying power by getting pre-qualified for a mortgage with us at Zillow Home Loans.

However, the requirements for getting one of these loans are specific and the fees for this type of loan, which are rolled into the loan amount, are usually higher. This will give you a good idea of the cost of selling your property. Unlike the buyer, who in most cases has to come up with quite a bit of cash, most of the cost of selling your property will come out of the money you get for the house.

There are two kinds of title insurance and you’ll need both when getting a mortgage. The lender’s title policy repays the bank that holds the loan in case the home is lost to a title claim. When you purchase newly built or heavily renovated housing, you will have to pay a sales tax on top of the purchase price. This sales tax consists of a federal portion and a provincial portion. In some provinces they are kept separate while in others, they are combined and called the Harmonized Sales Tax . The GST/HST almost always applies to new constructions but the cost may not have to be paid by the home buyer as the builder may cover the cost.

The principal is the amount of money being borrowed, also called the loan amount. Principal and interest account for the majority of your mortgage payment, which may also include escrow payments for property taxes, homeowners insurance, mortgage insurance and other costs. Conventional loan closing costs range between 2% and 5% of the purchase price. If you make a down payment of less than 20%, you’ll pay private mortgage insurance until you reach a loan-to-value ratio of 78%, when you can request discontinuation of the payment. It’s more accurate to call it a “no upfront closing cost loan.” Instead of paying your closing costs at closing, this loan type allows you to roll the charges into your total loan amount. In some cases sellers will take on a portion of the closing costs, lessening the initial financial burden on buyer.

For example, I sold a SF rental home for 30X earnings and reinvested $550,000 of the proceeds in real estate crowdfunding that pays a ~10% cap rate versus a 2.5% cap rate. And what happens if there is another refinance a few years down the road and yet another Discharge is not recorded? A problem will arise when the home owner attempts to sell the property and a title search of the property is conducted. If your home is part of a Homeowners Association, you will owe a prorated portion of the fees based on your closing date. Completing a professional home inspection prior to listing helps you avoid surprises and sale price reductions when the buyer completes their inspection.

This is often used in refinances, but with a purchase it’s a little trickier. Your Loan Advisor can run the numbers for you and give you some options. Homeowners insurance protects you financially from unexpected events that damage your home, such as natural disaster, theft or vandalism. Though homeowners insurance isn’t required by law, most mortgage lenders require it in some form. The cost significantly varies, and there are many options, so it’s best to compare offers to keep the expense as low as possible.

Lender’s title insurance repays the bank if you lose your home to a title claim. Unlike other types of insurance, you only need to pay for lender’s title insurance once at closing. Many lenders require you to pay for a year’s worth of homeowners insurance at closing. As a general rule, expect to pay about $35 a month for every $100,000 in home value.

D. Total Loan Costs.

Payment for closing costs can sometimes be financed with your loan, in which case it will be subject to interest charges. Alternatively, you can pay your closing costs in cash, similar to your down payment. Your property taxes will be prorated based on your closing date. Some buyers pay their taxes in lump sums annually or biannually. If you don’t pay this way, you might escrow the taxes, which means they would be included as an escrow line item in your monthly mortgage payment to your loan servicer.

Comments

Post a Comment